Managing financial transactions efficiently is crucial for individuals and businesses in the digital age. Credit card receipts play a fundamental role in this process as proof of payment for purchases made with a credit card. This article covers everything you need to know about credit card receipts, including an example of how tools like Shoeboxed can optimize your handling and organization of these documents.

Table of ContentsA credit card receipt is a physical or digital record issued after a credit card transaction. It details the purchase, including the date, merchant name, amount, and the last four digits of the card number.

At least two copies come with each valid credit card transaction.

Every credit card receipt includes the following transaction details:

Recent updates in payment processing rules have made it generally no longer required for customers to sign credit card receipts for most transactions in the United States. It's up to the credit card company whether a signed receipt is required.

Major credit card companies like Visa, MasterCard, Discover, and American Express have made customer signatures optional for merchants. This change reflects technological advancements, such as EMV chip cards and contactless payments, which provide more robust security against fraud than signatures.

There are several reasons that companies have shifted toward a ‘no signature’ policy on credit card receipts.

There are a few exceptions where signatures may be required.

For a business, the move away from signatures can mean:

Privacy and retention are the two main things to keep in mind when addressing the legal and compliance aspects of credit card receipts.

Privacy: Credit card receipts should only show the last four digits of the card account number to comply with PCI DSS (Payment Card Industry Data Security Standard) regulations.

Retention: Both businesses and individuals should retain credit card receipts for a specified period, typically determined by tax laws or the statute of limitations for audits.

Managing physical receipts can be cumbersome and inefficient in an increasingly paperless world. Shoeboxed is designed to digitize paper receipts and manage electronic receipts and other financial documents.

Shoeboxed allows users to scan a credit card printed receipt using its app and smartphone camera.

Magic Envelope

If you prefer to outsource the scanning, you can fill a pre-paid postage Magic Envelope with printed receipts and mail it to Shoeboxed, and they will scan, human-verify, and upload the receipts into your account.

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. 💪🏼 Try free for 30 days!

If you have electronic credit card receipts sitting in a Gmail account, Shoeboxed has a Gmail sync feature where you can auto-import receipts from your Gmail account directly to your Shoeboxed account. From your emails, the receipts are forwarded directly to your unique Shoeboxed email address, which is automatically imported into your account.

receipts will protect you from audits and verify that the expense is indeed deductible." width="600" height="300" />

receipts will protect you from audits and verify that the expense is indeed deductible." width="600" height="300" />

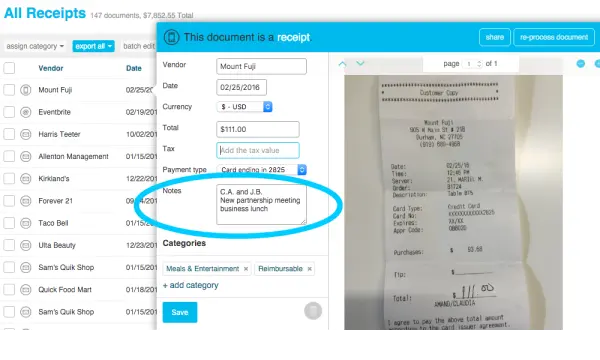

For a more detailed approach, you can add tags or notes to each receipt in Shoeboxed. This is particularly useful for credit card receipts to note the specific purpose of each transaction, such as distinguishing between different types of expenses or noting client-related expenditures.

Organization

The app uses OCR (Optical Character Recognition) to extract critical data from the credit card receipts, which are then categorized into 15 pre-selected or customized categories before being digitally stored.

Once expenses are assigned categories, you can generate detailed expense reports for reimbursements or tax purposes.

Integration with accounting software

Shoeboxed integrates with accounting software such as QuickBooks, Xero, and others. By managing your credit card receipts in Shoeboxed, you can ensure that all transaction data is accurately reflected and easily transferable to your central accounting system for comprehensive financial tracking and tax purposes.

Secure storage

All receipts are stored securely in the cloud with Shoeboxed, ensuring they are accessible from anywhere and compliant with data protection regulations.

Shoeboxed ensures that digital copies of receipts are compliant with IRS standards, making them audit-ready and suitable for tax purposes.

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Shoeboxed provides the following benefits to businesses and individuals:

Learn How a Multi-Campus Church Reclaims 20 Hours a Month with the Shoeboxed App

Major credit card issuers like Visa, MasterCard, Discover, and American Express have phased out the requirement for signed receipts on debit and credit card transactions in many regions. This change reflects advancements in credit card payments and security technologies such as EMV chips and contactless payments, providing more robust security against fraud than signatures.

Both businesses and individuals should retain old receipts for a specified period, typically determined by tax laws or the statute of limitations for audits. The IRS typically recommends that you or your business hold onto old receipts for at least three years.

Credit card receipts are more than just pieces of paper; they are vital records and documentation that support financial management and compliance. With the help of tools like Shoeboxed, individuals and businesses can transform how they handle these documents, enhancing efficiency for taxes and audits.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses various accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go—auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.